Shape the future of food

Invest in Swiss FoodTech

Never miss a deal.

Investing in Switzerland

Swiss consumers are willing to invest in new products that relfect their values and Switzerland’s geographical density makes it a fantastic test market for growing companies – and a perfect gateway to Europe.

Investing

Our FoodTech Investor Deal Flow connects Swiss and international investors with the latest Swiss seed to series A opportunities. Find out more about the companies seeking investment and sign up for updates by email below.

Invest in Swiss FoodTech Innovators

Abrinca genomics

Developing software to manage and analyse microbial genomes used in fields like medicine and fermented foods.

Find out more

Eat by Alex

Delivering science-backed nutrition programs to help busy people improve metabolic health and manage weight.

Find out more

Eggfield

Helping to replace egg functionality with plant-based proteins and extracts in the food industry and gastronomy.

Find out more

FoodFor™

Developing science-driven functional shots that enhance mental wellbeing and cognitive performance through clinically backed ingredients.

Find out more

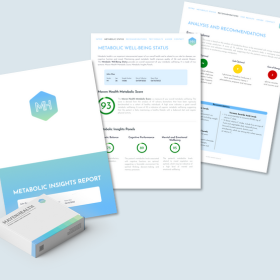

Maven Health

Find out more

Niatsu

Helping food manufacturers measure, report, and reduce their climate impact through AI-driven insights and satellite-powered data automation.

Find out more

NINO

Find out more

Saya Suka

Developing a synbiotic water beverage to help health-conscious consumers improve gut health.

Find out more

Steasy

Find out more

Trilliome

Find out more

Wonderfill

Are you Valley partner looking for funding? Click here to get featured.